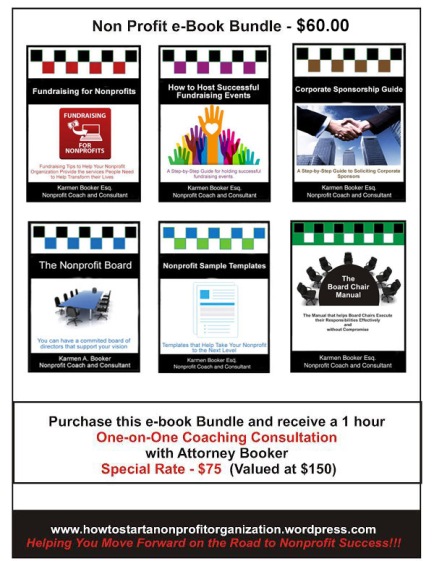

e-book Bundle Special

December 27, 2014Frequently Asked Questions Regarding Nonprofit Organizations

October 3, 20141. Are the services that I offer through my nonprofit required to be free?

Charitable organizations are not required to offer services or products free or at cost.

2. Can a nonprofit pay its staff?

A nonprofit can pay reasonable salaries to officers, employees, or consultants.

3. Are All Nonprofits Tax-Exempt?

No, they are not. Tax-exempt means that a nonprofit does not pay taxes on the income it receives to the federal government and (2) that its donors can take a charitable contribution deduction on their personal income taxes.

4. When do I need to apply for 501(c)(3) tax exempt status?

In order to receive a tax-exemption dating from the date of your incorporation, you need to apply within 27 months of the date of your incorporation.

5. Can we ask for donations before we get our tax-exempt status?

Yes. But the “effective date” of your nonprofit organization’s tax-exempt status will be the day that status was originally created.

6. What Is Unrelated Business Activity?

Conducting activities that are not in line with the purpose for which you formed the nonprofit organization. For example, if your nonprofit organization is a church and you lease space to a computer learning center. This is not related to church activities.

7. Can a Nonprofit Charge Fees for Its Services?

Many nonprofits count on fees from services they offer to clients for part of their annual incomes. There are several things to be aware of…

8. Can a Nonprofit Compensate Its Board Members?

Yes. Only about 2 percent of nonprofits compensate board members. However, they are usually not compensated, but volunteer.

9. Can an Organization Be Part Profit and Part Nonprofit?

No. The nonprofit organization must only provide services that comply with IRS rules and regulations as charitable, educational or religious.

10. Does Our Nonprofit Board Need Liability Insurance?

Most experts think that nonprofits need “Directors and Officers (D & O) liability insurance.

11. Can one make part of a for-profit business into a nonprofit?

You must establish 2 separate entities – For profit – to carry out for profit oriented purposes; and Nonprofit – to carry out charitable, educational or religious oriented purposes.

****************

Karmen A. Booker is an Attorney, Business Consultant and Owner of Compu-Perfect Professional Services, a business consulting firm specializing in Business Entity Formation (Corporations, Limited Liability Companies, and Nonprofit Corporations), Completing 501(c)(3) Federal Tax Exemption Applications, Grant Research and Writing services, and more. Call her today at (301) 408-1082.

Attorney Karmen A. Booker has developed a Report entitled “Fundraising for Nonprofits”, which provides information regarding:

- Developing a Fundraising Plan

- Writing a Fundraising Letter

- Over 27 Specific Fundraising Tips such as selling advertisement space in your newsletter and on your website, and more.

Click Here to GET YOUR COPY TODAY for Only $5.00

E-books

August 29, 2014

The Nonprofit Board is an e-book developed by Attorney Karmen A. Booker. It discusses the following:

* Are You Considering Being on the Nonprofit Board

* Recruiting Nonprofit of Members* Getting Nonprofit Board Members

* Legal Responsibilities of Nonprofit Boards

* Getting Commitment from Nonprofit Board Members

* Effective Nonprofit Board Leadership

* Tips for Having an Efficient Nonprofit Board Meeting

* Job Descriptions

It also has a Sample Nonprofit Board Survey Letter and a Sample Nonprofit Board Survey.“The Nonprofit Board” is a valuable resource for all Nonprofit Organizations who desire to discover information and tools that will help them recruit committed Board members and maintain organization efficiency through the Board. GET YOUR COPY NOW – on SALE for $9.99

Just click on the BUY NOW button below

- Sample Mission Statements

- Sample Business Plans

- Sample Donor Solicitation Letter

- Sample Thank You Donor Letter

- Sample Press Release

- Sample Letter of Inquiry

- Sample Corporate Donation Letter

- Sample Board Member Application

- Sample Board Member Agreement

- Sample Volunteer Application

- Sample Volunteer Agreement

- AND MORE

GET YOUR COPY NOW on SALE for ONLY $9.99

Just click on the BUY NOW button below

Attorney Karmen A. Booker has developed an E-book called “Fundraising for Nonprofits”. It provides Fundraising Tips that include but are not limited to:

- Developing a Fundraising Plan

- Writing a Fundraising Letter

- Over 15 Specific Fundraising Projects such as selling advertisement space in your newsletter and on your website, and more.

Get Your Copy NOW for $5.00

Just click on the BUY NOW button below.

“How to Hold Successful Fundraising Events” is an e-book developed by Attorney Karmen A. Booker. It discusses:

Choosing What Type of Event to Host

Setting Up an Event Host Committee

Setting the Ticket Price

Planning the Event

Event Speakers

Ticket Selling Structure

Finding Attendees

Turning Pledges Into Dollars

Fundraising Event Checklist

Get Your Copy NOW on SALE for ONLY $9.99

Just click on the BUY NOW button below.

Attorney Karmen A. Booker has developed the “Corporate Sponsorship Guide“ where YOU will Learn:

* How to Draft a Solicitation Letter

* What Corporate Sponsors are Looking for in Charitable Events* The Best Way to Approach Prospective Sponsors* Where to Start

NOTE: Includes an 8 Step Guide and templates and samples of Corporate Sponsorship Solicitation Letters.

Get Your Copy NOW on SALE for only $9.99

Just click on the BUY NOW button below.

Five Tips That Help Produce a Great Nonprofit Board – Getting Your Board Members on Board

August 15, 20141. Select Wisely

Wisdom, integrity and commitment, are critical. Therefore, select people to serve on your board who truly believe in who you are, what you do, how you do it, and who care enough about your organization to go into the community and actively persuade others to support your work.

2. Articulate Your Expectations

Before bringing them on board, let them know your expectations and their responsibilities.

3. Create a “Messaging Package”

Everyone affiliated with your organization needs to “stay on message” when it comes to explaining to others what your organization is all about. Therefore, create a “messaging package” that includes a positioning statement, or “elevator speech,” as well as supporting statements that clearly articulate your organization’s key messages. Be sure that everyone in your organization knows what those messages are.

4. Encourage Board Members to Deliver Your Messages to the Community

Once board members understand your brand messages, encourage them to speak in front of local civic organizations such as the Chamber of Commerce, YMCA, YWCA, and church groups to tell their colleagues and families about your organization and the important work it performs in your community. These are all effective and cost-free branding opportunities that many organizations overlook.

5. Get Your Board Members to Work as a Team

Board members need each other’s support, and need to know each other as colleagues who share a common mission. If they exchange ideas at regularly scheduled board meetings and informally between meetings, they are more likely to promote the organization’s mission and support its fund-raising activities.

* * * * * * * * * * * * * * *

Karmen A. Booker is an Attorney, Business Consultant and Owner of Compu-Perfect Professional Services, a business consulting firm specializing in Business Entity Formation (Corporations, Limited Liability Companies, and Nonprofit Corporations), Completing 501(c)(3) Federal Tax Exemption Applications, Grant Research and Writing services, and more.

The Nonprofit Board is an e-book developed by Attorney Karmen A. Booker. It discusses the following:

* Are You Considering Being on the Nonprofit Board

* Recruiting Nonprofit of Members

* Getting Nonprofit Board Members

* Legal Responsibilities of Nonprofit Boards

* Getting Commitment from Nonprofit Board Members

* Effective Nonprofit Board Leadership

* Tips for Having an Efficient Nonprofit Board Meeting

* Job Descriptions

It also has a Sample Nonprofit Board Survey Letter and a Sample Nonprofit Board Survey.

“The Nonprofit Board” is a valuable resource for all Nonprofit Organizations who desire to discover information and tools that will help them recruit committed Board members and maintain organization efficiency through the Board.

Posted by kbooker

Posted by kbooker